Tax Bill Information

Contact Us

Property taxation is a key source of revenue for the Town of St. Marys. This revenue helps to fund many services, for example, fire, policing, infrastructure upgrades and recreational facilities and programs such as the Pyramid Recreation Centre and the St. Marys Public Library.

Property tax due dates

Property taxes are paid four times per year in St. Marys:

- First installment - due the last business day of February

- Second installment - due the last business day of May

- Third installment - due the last business day of August

- Fourth installment - due the last business day of October

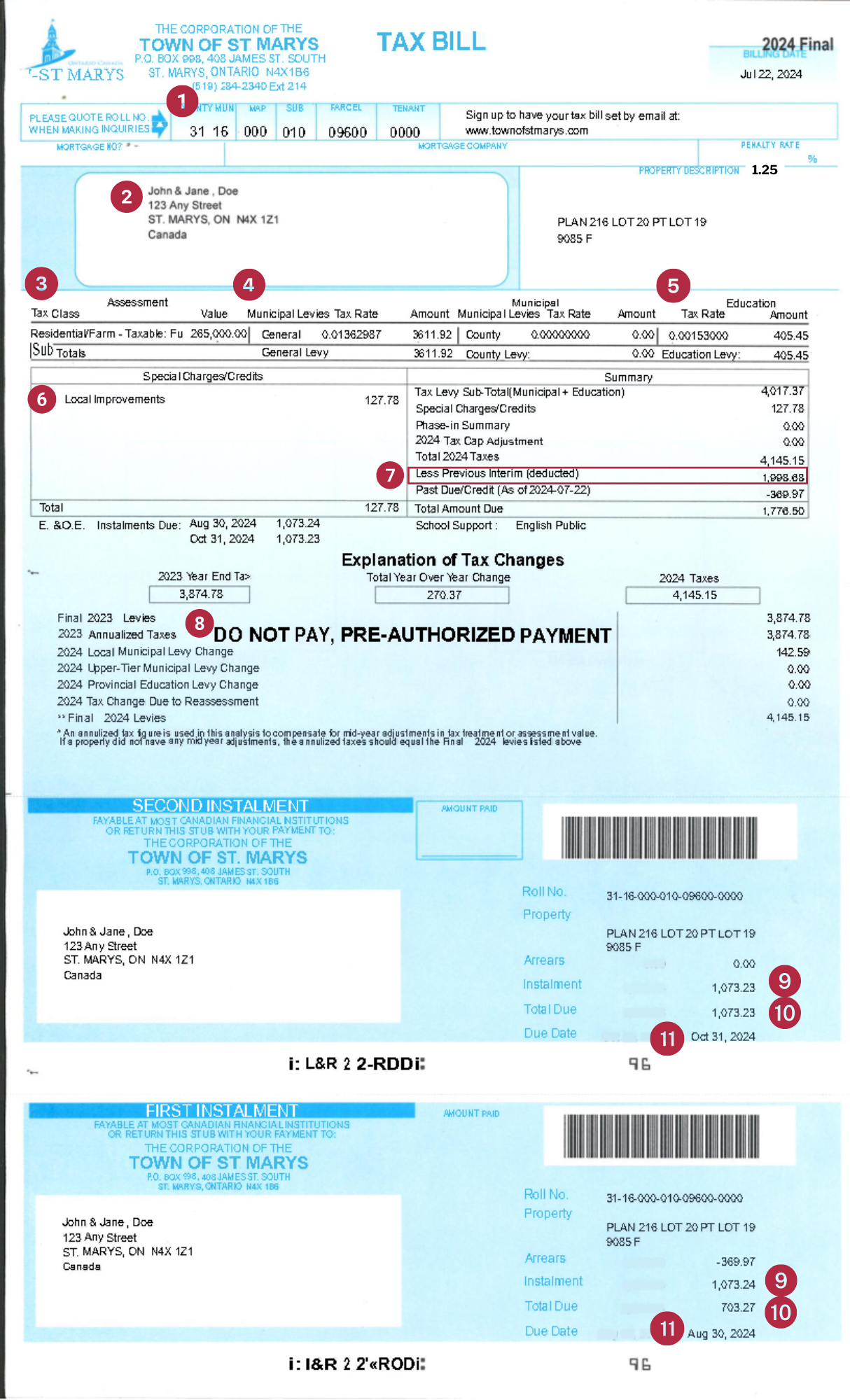

How to read your property tax bill

Please click to expand the tax bill example.

Legend

|

1. Roll number |

| Roll number associated with property. |

| 2. Property description |

|

| 3. Assessed value of property |

|

This amount is determined and regulated by the Municipal Property Assessment Corporation (MPAC). If your assessment has changed, you would have received a notice from MPAC. Property owners can retrieve more details about their property assessment using MPAC's AboutMyProperty portal. For more information, please visit www.mpac.ca. |

| 4. Municipal tax rate |

|

The tax rate applied to the assessment determines the Municipal Tax Levy amount, funding services like policing, recreational programs, libraries, roads, and sports facilities. For more information on the Municipal tax rate in the Town of St. Marys, visit our Annual Budget page. |

| 5. Education tax rate |

|

This is the tax rate applied to the assessment to determine the amount of Provincial Education Levy that is collected and remitted to the School Board, as selected by the resident. This rate is set by the Province and more information can be found by visiting www.ontario.ca. |

| 6. Local Improvements |

|

This is the Town Wheelie Bin Charge. The Town partners with Bluewater Recycling Association (BRA) to provide curbside garbage and recycling collection. This amount is determined by the size of your bin. For more information, visit www.bra.org. |

| 7. Less Previous Interim (deducted) |

| The interim bill represents 50% of the total taxes paid in the previous year. It is issued at the start of the year and has two installment due dates – the last business day in February and the last business day in May. This amount is subtracted from the final taxes calculated for the year since the interim has already been billed. |

| 8. DO NOT PAY, PRE-AUTHORIZED PAYMENT |

|

This only applies to residents who are signed up for a pre-authorized payment program. This will not appear on your bill, if you are not signed up. If you are interested in signing up for this program, please fill out the Pre- Authorized Tax Payment Form. |

| 9. Installment |

| All tax bills, whether Interim or Final, require two installment payments. For Interim bills, payments are due on the last business day of February and May, while for Final bills, payments are due on the last business day of August and October. Each installment is 50% of the total tax bill and must be paid on the corresponding due dates listed. Any carryover credit or past due amount is included in the installment payment. |

| 10. Total due |

| This refers to the payment that needs to be made by the installment's due date. |

| 11. Due date |

| Payment due date. |

Fore more information on your property tax bill, please contact the Finance Department at 519-284-2340, ext. 214