Annual Budget

Contact Us

The Town of St. Marys annual budget is an itemized summary of money coming into the municipality. The budget directs how that money will be spent over a specific period of time. The amounts to be spent are determined through input from staff and the public, legislated requirements, and sometimes needs beyond anyone's control, such as funds to replace aging infrastructure with limited resources.

2025 Budget Process

Staff presented the draft 2025 budget to Council on October 15 and November 19, 2024 at 9:00 am at Town Hall in Council Chambers.

You can participate by:

- Attending the meetings in Town Hall Council Chambers

- Submitting comments or questions prior to the meetings by email

- Viewing the meetings virtually on our YouTube channel

Meeting agendas and minutes are available on our Council and Committee Calendars page.

Watch the pre-budget and priority setting at the Strategic Priorities Meeting held on July 16, 2024.

Budget Documents

View a detailed version of the 2025 Municipal Budget.

2025 Budget

Town Council voted unanimously in favour of the 2025 budget on January 28, 2025.

The budget calls for an additional $816,021 (5.48%) to be raised through property taxes in 2025.

When adjusted for growth, this will result in a 3.63% ($130) annual property tax increase for a typical residential property. Water and sewer bills will increase by 3.19% or $29 annually for the average residential household.

These funds are required to provide day-to-day municipal services and support strategic projects.

Budget Documents

View a detailed version of the 2025 operating budget. The operating budget covers the day-to-day costs of running the municipality.

View a summary if the 2025 capital budget. The capital budget covers the cost of major, one-time projects led by the municipality.

The table below outlines the municipal burden on the average residential dwelling in St. Marys. The municipal burden is the amount an average residential property owner in St. Marys pays in property tax and water and wastewater fees.| 2024 | 2025 | Percentage Increase | Dollar Increase | |

|---|---|---|---|---|

| Median municipal tax - residential dwelling2 | $3,571.03 | $3,728.77 | 3.63% | $130.00 |

| Wheelie bin | $144.03 | $132.89 | 4% | $5.00 |

| Education tax 3 | $400.86 | $403.92 | 0% | $0 |

| Total - property tax bill | $4,115.92 | $4,265.58 | 3.28% | $136.00 |

| Water4 | $444.29 | $434.46 | 1.7% | $7.00 |

| Wastewater4 | $486.47 | $508.62 | 4.5% | $22.00 |

| Total - utility bill | $930.76 | $943.08 | 3.19% | $29.00 |

| TOTAL MUNICIPAL BURDEN | $5,046.68 | $5,208.66 | 3.44% | $165.00 |

2 Municipal tax (does not include education tax) based on median assessment of $264,000

3 Education rates prescribed by the province - confirmed

4 Based on average use of 12 cubic meters per month

Below are summaries of the factors and proposed service level changes impacting the 2025 budget. These changes will result in an $816,021 increase over the 2024 budget.

| Major Budget Impacts | ||||||||||||||||||

|

||||||||||||||||||

| Proposed Service Level Changes | ||||||||||||||||||

|

Frequently Asked Questions

| How do property taxes in St. Marys compare to other municipalities? |

|

In 2019, St. Marys participated in the BMA Residential Taxes Comparison Study. St. Marys falls among the "mid" range municipalities for residential property taxes. While St. Marys residential tax rate alone may seem to be higher than the average community, when applied to the average property assessment, the average dollar amount paid in residential taxes puts St. Marys in the mid-range when compared to other municipalities. To better understand how the tax rate is determined, please see the video under the next question. For further details on this study, you can view the full Municipal Study here. A printed copy of this study is available upon request. |

| How is the tax rate determined? |

|

In setting the annual budget, and thereby arriving at the municipal tax rate, the Town determines all anticipated expenses, deducts the revenue it expects to receive, and arrives at an amount to be raised from property taxation. This amount is divided by total property assessment to arrive at a property tax rate. Annual tax rates are calculated during the spring budget process. Once the tax levy by-law has passed, the rates will be posted in PDF format on this page. |

| How is the annual budget determined? |

|

| How are taxes spent? |

|

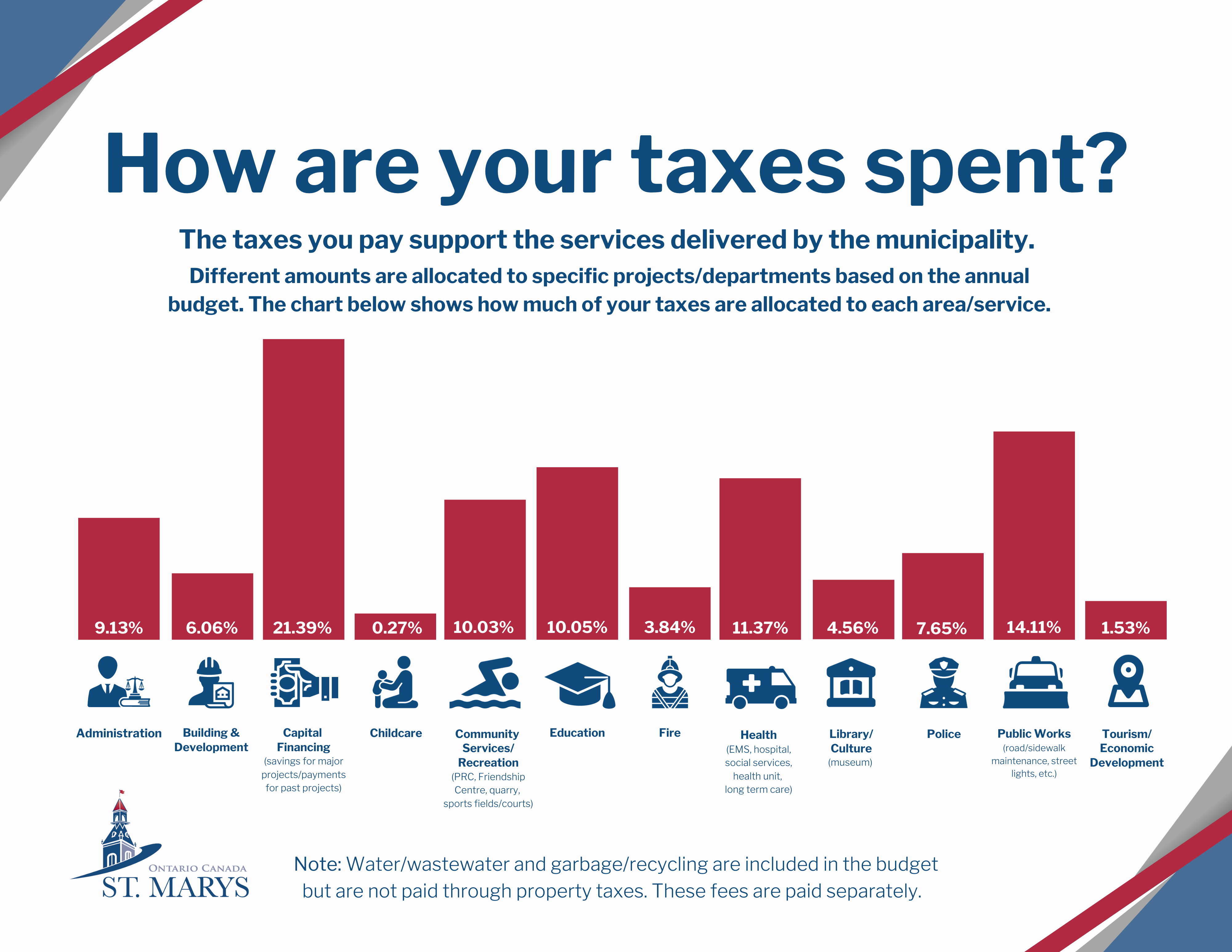

The taxes you pay support the services delivered by the municipality. Different amounts are allocated to specific projects/departments based on the annual budget. The chart below shows how much of your taxes are allocated to each area/service.

|

| Where can I find more information on property tax rates, due dates, certificates and more? |

| Please visit our Property Taxes webpage for more information. |